Barnett Center for Innovation | Jacksonville, FL

The Barnett Center for Innovation, is a Chase Bank anchored $50 million historic and New Markets Tax Credit development project, reactivating an 18 story Landmark and vacant former Bank building in the central business district of downtown Jacksonville, Florida.

Urban Trust Capital advised on the $8.1 million of historic and the $6.6 million of New Markets Tax Credits. Along with the historic preservation of the building, a new mixed use program, included a downtown location for the University of North Florida’s School of Business, the One 12 Collaborative a business Incubator tenant and a Florida SBDC office, and approximately 110 residential units and supporting retail uses will be developed as part of this unique catalytic driver for downtown Jacksonville.

The Thompson Building | Hot Springs, AR

The Thompson Building project is a rehabilitation of one of Arkansas’s landmark historic buildings in the Central Avenue Historic District of Hot Springs, AR by TKZ, LLC, Urban Trust repeat clients in Hot Springs, AR.

The Thompson Building has been renovated into The Waters a boutique hotel with an Ascent flag and opened in January 2017. The $9.8 million project generated $1.8 million in historic tax credits.

Swift Mill Lofts | Columbus, Georgia

$6 million historic rehabilitation for Phase One of the historic 1891-1941 Swift Mill Complex in Columbus, Georgia.

Urban Trust placed the $1.2 million in federal historic tax credits and the $300,000 in State historic tax credits with a Georgia closely held corporation for the 60 unit rental apartment project.

Baldwin Lofts | Milledgeville, GA

A $3.5 million historic rehabilitation of a former Belk’s Department store in Milledgeville, Georgia. In addition to placing the $737,000 in federal credits and the $300,000 in State credits Urban Trust arranged the bank financing for the client and managed the construction and development of the project through an affiliated company.

Quapaw Bathhouse | Hot Springs, AR

A $3.8 million rehabilitation of a 1920’s National Landmark Bathhouse in Hot Springs, AR. The Quapaw is one of seven historic landmark bathhouses on Bathhouse Row in the Hot Springs National Park and the downtown Central Avenue Historic District.

Grandfathered as a 25% historic tax credit the Quapaw has been rehabilitated as a SPA. Owned by the National Park Service a pass-through lease structure was used to lease the Quapaw to local developers and generate the $923,000 in historic tax credits. Urban Trust secured a national bank as a tax credit investor.

Carnegie Marriott Courtyard | Atlanta, GA

A $30 million rehabilitation of a 1920’s office building located in downtown Atlanta, GA into a 155 room Marriott Courtyard.

Urban Trust is providing historic and New Markets Tax Credit services for the developers. The $3 million in historic tax credits were placed with a Fortune 500 company.

Eastside Loft Apartments Phase II | Little Rock, AR

Phase II of a historic high school rehabilitation into 34 one and two bedroom affordable and market rate apartments in Little Rock, AR. The $9.5 million Phase II project included the renovation of the high school auditorium, which generated $2.5 million of Low Income Tax Credit equity and $1.1 million of historic tax credits.

Urban Trust provided its non-profit tax credit financial advisory services to the Arc Arkansas, a nonprofit organization that provides services and affordable housing to individuals with disabilities and their families. The Eastside project is designed to a “universal design concept” standard so that all units are accessible for the disabled.

Old Town Holiday Inn and Suites | Baltimore, MD

Urban Trust provided its tax credit advisory services for the rehabilitation of the Old Town Bank building into a 70 room Holiday Inn and Suites in downtown, Baltimore, MD.

The $11.9 million renovation generated $1.9 million in federal historic tax credits and $840,000 in Maryland state credits. Urban Trust assisted in structuring the tax credit transaction, negotiated the investment price, terms and tax credit equity with investors and assisted in closing the transaction.

20 West Adams | Jacksonville, FL

A $9.9 million rehabilitation of a 1911 former Drug Company Building in downtown Jacksonville, FL. One of the few buildings constructed in Florida during the first two decades of the twentieth century to reflect design elements of a new commercial high-rise style referred to as the Chicago school, and identified as the forerunner of the modern skyscraper.

Urban Trust provided its services for the financial structuring of the project and secured the $1.6 million of historic tax credit equity.

Phoenix Hotel | Waycross, GA

A $7 million redevelopment of a former railroad hotel in Waycross, GA for downtown corporate office and retail uses. The Phoenix is a Waycross Downtown Development Authority owned property leased to a for-profit entity and managed by the Authority’s for-profit subsidiary.

In addition to securing $1,097,258 in federal tax credit equity investment for the Authority client Urban Trust assisted in the legal and financial structuring of the deal.

West Lofts | Rome, GA

A $3.6 million rehabilitation of two turn- of-the-19th century downtown buildings in Rome, GA’s Main Street District for 18 luxury loft residential units and retail.

Urban Trust secured $600,000 in federal tax credit equity for the private client.

Fitzpatrick Hotel | Washington, GA

$2.2 million rehabilitation of an 1892 National Register 17 room boutique hotel in Washington, GA. Due to the small amount of tax credits the owners could not find an investor and turned to Urban Trust.

We secured an investor specializing in small historic rehabs for the $315,000 tax credit equity investment. The Fitzpatrick is featured on the national Trust for Historic Preservation website as a case study of a small historic rehabilitation investment.

WaterMark Tower | Anniston, AL

The $5.2 million historic rehabilitation of a 10 story 1923 skyscraper in downtown Anniston, AL for professional office and retail. The project is a partnership between a local utility authority and local investors/developers and includes historic tax credits estimated at $1,100,000. Urban Trust provided its full range of tax credit services for the client.

Five Points Theatre and Office Building | Jacksonville, FL

A $5.9 million rehabilitation of a 1920’s building for office, retail and an events center in Jacksonville, FL. Urban Trust was responsible for soliciting and receiving five bids for the tax credit investment and negotiating the $692,000 equity investment price, terms and formula.

Georgia Children’s Museum | Macon, GA

$6.4 million three-phase rehabilitation of two historic buildings in downtown Macon, GA into a Children’s Museum and Events center for children. The Museum buildings are owned by a nonprofit, leased to a for-profit entity, and managed by the nonprofit’s for-profit subsidiary as a part of the structuring of the tax credit project.

Urban Trust provided a full range of structuring, financial analysis and Tax Credit services and secured the placement of $1,108,799 in Tax Credit equity from one of the nation’s largest financial institutions.

Old Zebulon School | Zebulon, GA

The historic old Zebulon school is a historic rehabilitation of the historic Zebulon Elementary School building in Zebulon, Georgia. Built in 1926 it was listed on the Georgia Trust for Historic Preservation’s 2017 “Places in Peril”. Urban Trust Capital advised on the $3.5 million rehabilitation and was also a development advisor for the development group.

The building was purchased by the Zebulon Downtown Development Authority and was transferred to a newly created for-profit to rehabilitate the building under a public-private partnership with the Authority.

Laura Street Trio | Jacksonville, FL

The Laura Street Trio (Trio) is a $80 million historic tax credit rehabilitation project, reactivating three Landmark historic buildings in the central business district of downtown Jacksonville, Florida. Urban Trust Capital secured a $9 million investor for the historic tax credits and was one of the financial advisors for the proposed development.

Lafayette Hotel | Little Rock, AR

The Lafayette project is a $20 million historic rehab of a 10 story National Register building in downtown Little Rock built in 1925. The project is being developed by G&G Lafayette, LLC. Upon completion the building will house 80 hotel rooms, a café, an upscale restaurant and condominiums on floors six through ten. The property is expected to operate as a Kimpton by IHG. Urban Trust Capital is providing tax credit advisory and placement services for $2.8 million of Federal Historic Rehabilitation Credits and $4.9 mm of Arkansas Historic Preservation Credits under special legislation passed by the Arkansas legislature.

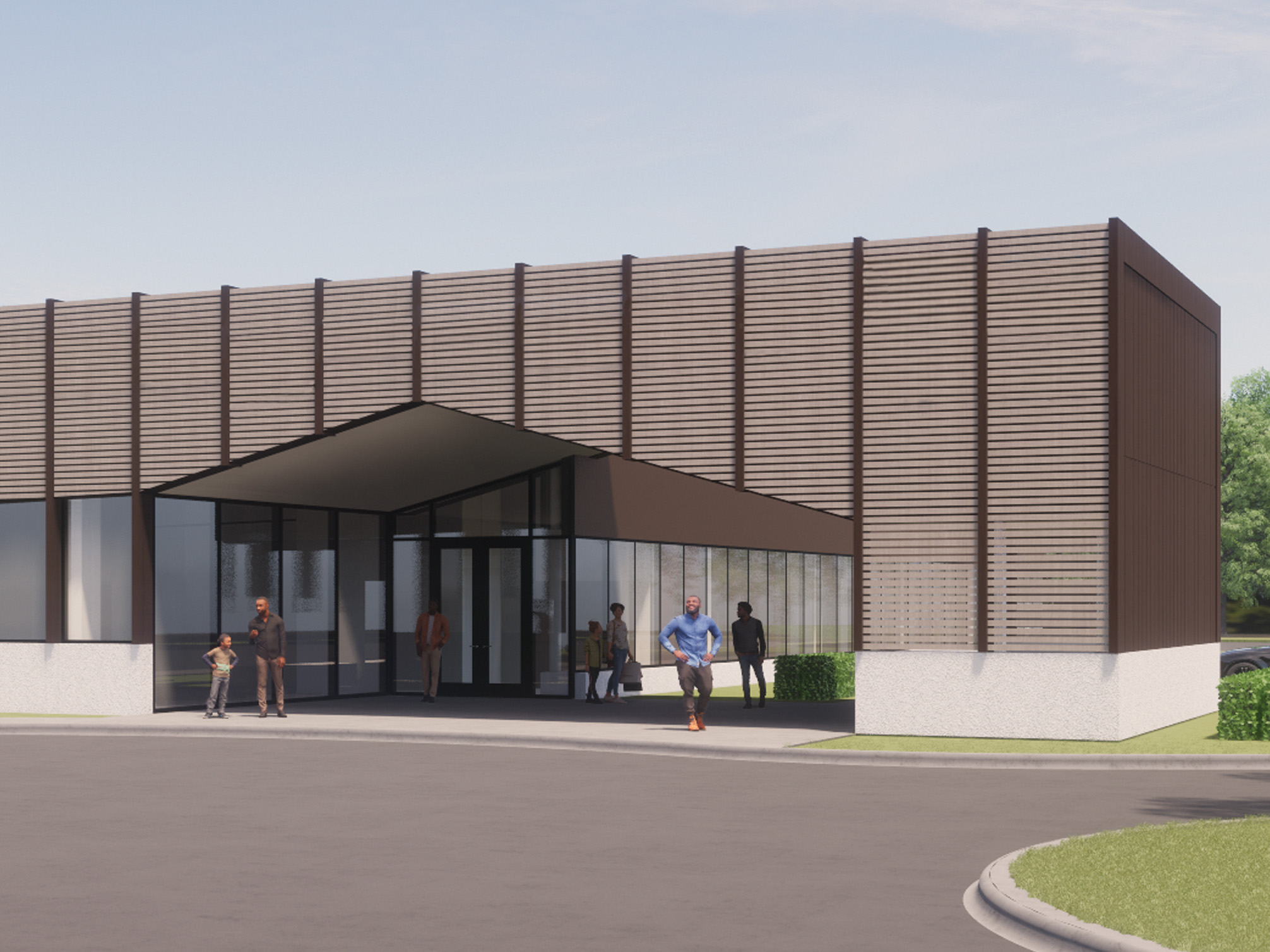

McIntosh Community Achievement Center | Jacksonville, FL

New Markets Tax Credits

Urban Trust Capital is tax credit advisor to the Dr. C.B. McIntosh Community Achievement Center incorporating Kappa Alpha Psi Foundation’s fifty-one-year old Guide Right mentoring program for young men and Sulzbacher Center, a Federally Qualified Health Center Pediatric Clinic which will operate Village Pediatrics as the medical component. The $6.6 million New Markets Tax Credit project is located in an underserved Health Zone 1and a highly stressed LMI census tract. Senior debt is being provided by the Jacksonville Local Initiatives Support Corporation (LISC) Office. The sponsor and tenants are all nonprofits.

Jonesboro Firehouse | Jonesboro, GA

Georgia Rural Zone Tax Credits

Urban Trust Capital was tax credit advisor on a historic Fire House building in Jonesboro, Georgia. The 6,650-square foot long-time vacant and deteriorated building located in downtown Jonesboro at 103 W. Mill Street. This $2.6 million rehabilitation project was undertaken by the Jonesboro Downtown Development Authority (DDA) through a wholly owned subsidiary Jonesboro Economic Development Corporation with financing through the local Urban Redevelopment Authority (URA) of which approximately $2.1 million was eligible for Georgia’s Rural Zone tax credits. The project was the first project to receive a private investment under the State’s Rural Zone Tax Credit program.

Housing Solutions of Jacksonville | Jacksonville, FL

New Markets Tax Credits

The Client is redeveloping a group of warehouses in Jacksonville, FL commonly known as the Housing Solutions Center of Jax. The project is located at 1200 Talleyrand Avenue, Jacksonville, FL 32206. Upon completion, the estimated almost $20 million dollar Project will serve as an affordable housing manufacturing facility and Housing Research Center. Based on the estimated hard and soft cost budget provided by Developer’s representatives the Project may qualify for and generate approximately $20 million federal New Markets Tax Credits allocation from a CDE.

Jackie Robinson National Register Ballpark | Daytona Beach, FL

Urban Trust Capital was tax credit advisor to a nonprofit redeveloping the National Register Jackie Robinson Ballpark in Daytona, FL. Urban Trust worked with the IRS Special Industries Branch to qualify the Ballpark as a historic building eligible for federal historic tax credits. The IRS determined that a building was “four walls and not necessarily a roof”. The Jackie Robinson Ballpark was the first historic sports structure to qualify for the federal tax credits and Urban Trust Capital’s efforts led the way for Boston’s Fenway Park and other historic sports stadiums to qualify for the federal historic credit. The historic credits were placed with a national bank’s investment Fund.

The historic ballpark opened in 1914 and is the 4th oldest ballpark still used in professional baseball. The ballpark was renamed after Jackie Robinson in 1989 and the rehabilitation was completed in 2002. Today, the Daytona Tortugas, the Class A-Advanced affiliate of the Cincinnati Reds in the Florida State League play in the Ballpark.

City of Clarkesville, GA

Urban Trust Capital was retained as tax credit advisor for the historic rehabilitation of four historic downtown properties damaged by fire. The properties were acquired by the City of Clarkesville with the intent to redevelop as part of an overall downtown redevelopment strategy which included structuring the $2.9 million rehab of the buildings under a partnership structure controlled by the City’s Downtown Development Authority (DDA) and its wholly owned subsidiary the Clarkesville Economic Redevelopment Group.

Savannah Multi-Family Rehabilitations | Savannah, GA

Urban Trust was tax credit advisor to a multi-family developer in Savannah who rehabbed a number of deteriorating apartment buildings in the historic district. Urban Trust arranged the placement of the Georgia historic tax credits with a Georgia Bank’s Trust Department.

The Castle Building | Atlanta, GA

Urban Trust placed the federal and State historic credit with investors for the historic Castle building located at 87 15th Street, NE, Atlanta, GA into a quality restaurant and club facility with a boutique hotel component, cocktail bar and event space. The $3.3 million dollar Project, which included a new construction component generated approximately $2,981,980 in qualified rehabilitation expenditures.

Tyer Temple/Sanctuary | Tampa, FL

Urban Trust Capital secured federal historic tax credits from an investor for the rehab of a former Methodist Church located in the historic Tampa Heights neighborhood near Tampa’s downtown and Ybor City. The church was repurposed as one and two story loft apartments and office space. Urban Trust Capital’s principal was an equity partner in the development and on the development team.